Nuggies: Quantifying Racial Bias and Publicly Traded Baseball Teams

Thursday, October 22nd, 2020

Welcome to the twenty-third edition of Nuggies, an email newsletter that aggregates articles and commentary on business, economics, startups, and more, in bite-sized nuggets sent right to your email weekly. Created by and for college students.

Our quote of the week comes from Ernest Hemingway, “Never mistake motion for action.”

This Week’s Articles:

Economist Found $16 Trillion When She Tallied Cost of Racial Bias, Bloomberg

This article discusses the work of a global economist for Citigroup, who discovered that racial bias and inequity for people of color has led to $16 trillion in economic losses. And this is just since the year 2000. Her report takes into account inequalities in lending, housing, education, and more, to provide a comprehensive view of how people of color have been disenfranchised and how it impacts our broader economy. Her report concludes by saying that by working against racial bias in our socio-economic systems, we could gain an additional $5 trillion in economic activity over the next 5 years alone.

Read it here

Stripe acquires Nigeria’s Paystack for $200M+ to expand into the African continent, TechCrunch

This is a historic deal for the M&A world and for American payments giant Stripe, as it is the biggest acquisition ever to come out of Nigeria, and Stripe’s first of this size. This is just the next move in Stripe’s new strategy to extend their footprint to more geographies, as before this deal they had expanded into 17 new countries over an 18 month time span. Paystack is a big deal of its own however, as the first company out of Nigeria to participate in famed accelerator Y Combinator, and the main payment company of Nigeria, with over 60,000 customers. In this light, it seems like a perfect deal, two rockstar companies coming together to strengthen what they each built.

Read it here

Inside the deal to take the Boston Red Sox public, Axios

If this year wasn’t already crazy enough, there is a SPAC bidding to take a 25% stake in the Boston Red Sox public. This SPAC (special purpose acquisition company) is co-run by the private equity titans Billy Beane and Gerry Cardinale, who have a long history in sports investing. This would value the Red Sox’ parent company, Fenway Sports Group, at $8 billion, including their subsidiaries the Liverpool F.C. and a NASCAR team. In terms of ROI, the Red Sox were bought by hedge fund billionaire John Henry in 2001 for $700 million, and Liverpool a few years later for £300 million. Not too bad at all.

Read it here

This Week’s Tweets:

This Week’s Wildcard (an extra, interesting nugget):

Here are a few instances of failed forecasts:

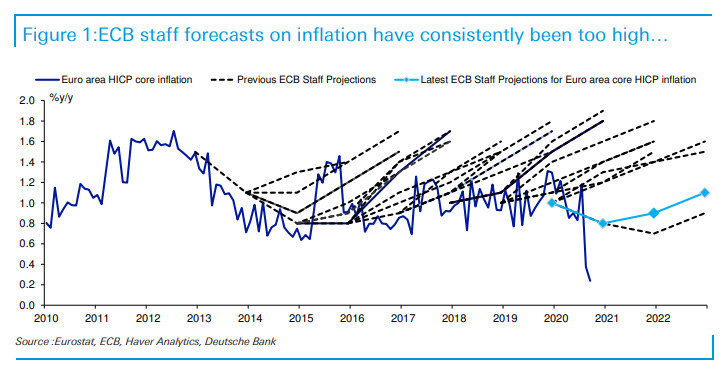

First, the European Central Bank’s inflation forecasts have consistently missed.

Second, the Japanese government consistently missed birthrate forecasts:

This Week’s Question:

Have you ever heard of Quibi?

What are we listening to this week?:

In light of the wildly unsuccessful “Restoration Week” that Notre Dame tried to pass off as a fall break, we’re listening to Benny the Butcher’s eternally slept on 2019 project The Plugs I Met. Hailing from Buffalo, NY, a close neighbor of the far superior Rochester, NY, Benny will always be welcome in the rotation. What this 24 minute tape lacks in depth it makes up for in grit and god-level flow, topped off by the king of coke rap himself, Pusha T. The intro alone stands as a masterpiece and The Plugs I Met is definitely worth a listen.

Thank you for reading! Nuggies is created by Thomas Pero and Spencer Koehl, two undergraduate students at the University of Notre Dame.

If this was forwarded to you, please subscribe here:

If you have any comments, feedback, or suggestions, please feel free to reach out to us at tpero@nd.edu and skoehl@nd.edu, or on twitter, @tpero_ and @spencerkoehl

While this is a labor of love, if you would like to support our efforts please share this with friends and on social media.