Nuggies: Sports, LSD, and a Vaccine Rally

Thursday, December 10th, 2020:

Welcome to the twenty-eighth edition of Nuggies, an email newsletter that aggregates articles and commentary on business, economics, startups, and more, in bite-sized nuggets sent right to your email weekly. Created by and for college students.

Our quote of the week comes from the recently passed, first human to break the barrier of sound, Chuck Yeager, “You do what you can for as long as you can, and when you finally can't, you do the next best thing. You back up but you don't give up.”

This Week’s Articles:

The Nobel Prize-Winning, LSD Dropping, Yet Problematic Scientist Who Invented PCR, Elemental

PCR has become not only a critical technology in combatting the COVID-19 pandemic, but also an important technology biochemistry. The idea was novel enough to earn its inventor, Kary Mullis, a Nobel Prize. However, it’s also an example of what happens when good ideas come from uncommon sources. This is an interesting read about eccentric scientist and how his actions caused his idea to gain traction within the academic community.

Read it here

Why economists don’t think sports matter for the economy, Quartz

This piece turns a critical eye to the effect of professional sports on their local economies. While many teams argue sports teams lead to an increase in spending from consumers in efforts to woo support from city and state governments, research shows sports spending often crowds out other forms of entertainment spending. Despite this, research shows there are other, non-monetary benefits to hosting a local team.

Read it here

The Emperor Will Buy New Clothes, Eric Newcomer

This piece looks at the lofty valuations of private, recently public, and soon to be public tech companies (think Uber, AirBnb, and DoorDash) and explores whether or not these huge valuations make these tech companies a bubble. This is a great blog post that builds an analogy between private tech companies and the old tale of the Emperor’s New Clothes. Newcomer suggests that these lofty valuations are supported by the tech companies’ wild growth rates, as investors believe that they will be able to monetize after capturing a significant amount of the market. Just look at DoorDash, which IPO’d yesterday and is valued at over $60B despite losing $150 million dollars in the first nine months of the year.

This is a great read, which you can find here

The ‘everything rally’: vaccines prompt wave of market exuberance, Financial Times

For anyone with as much as a passing interest in the stock market, this should be a must read. It examines the recent bull run in the stock market post election and vaccines, what it means, and how people are taking advantage of it. It takes a comprehensive look at our current equity markets and is a great, fun, engaging read. One our of favorite quotes from it comes from the head of Interactive Brokers:

“Money is now so easy, why not borrow what you can and put it into stocks? That’s what our customers are doing, and they’re making helluva lot of money”

Read it here

This Week’s Tweets:

^This is a highly recommended thread from a founder of DoorDash on how they started the company. You’d be surprised and inspired by the easy, humble beginnings of this $60B+ tech giant

^a different DoorDash take

This Week’s Wildcard (an extra, interesting nugget):

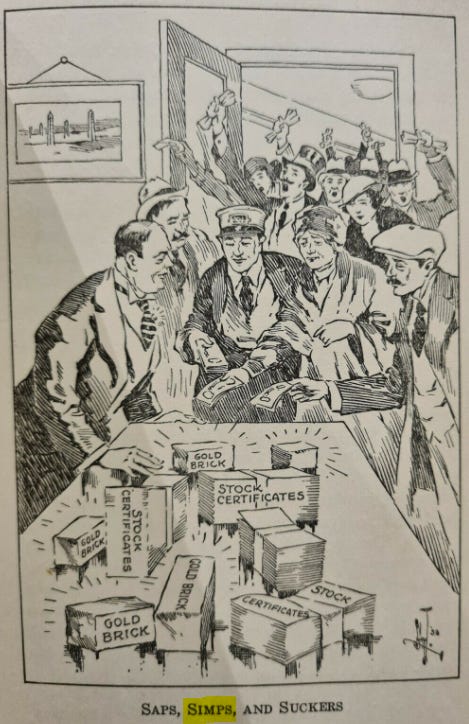

A 1933 finance cartoon calling investors simps. (Credit: @InvestorAmnesia)

This Week’s Question:

Which company will be more successful in 10 years: AirBnB or DoorDash?

What are we listening to this week?:

This week, we’re listening to Snarky Puppy’s 2014 album “We Like it Here.” Snarky Puppy is a modern jazz collective with a genre-blurring sound. They also record everything live with fans sitting between band members.

Thank you for reading! Nuggies is created by Thomas Pero and Spencer Koehl, two undergraduate students at the University of Notre Dame.

If this was forwarded to you, please subscribe here:

If you have any comments, feedback, or suggestions, please feel free to reach out to us at tpero@nd.edu and skoehl@nd.edu, or on twitter, @tpero_ and @spencerkoehl

While this is a labor of love, if you would like to support our efforts please share this with friends and on social media.